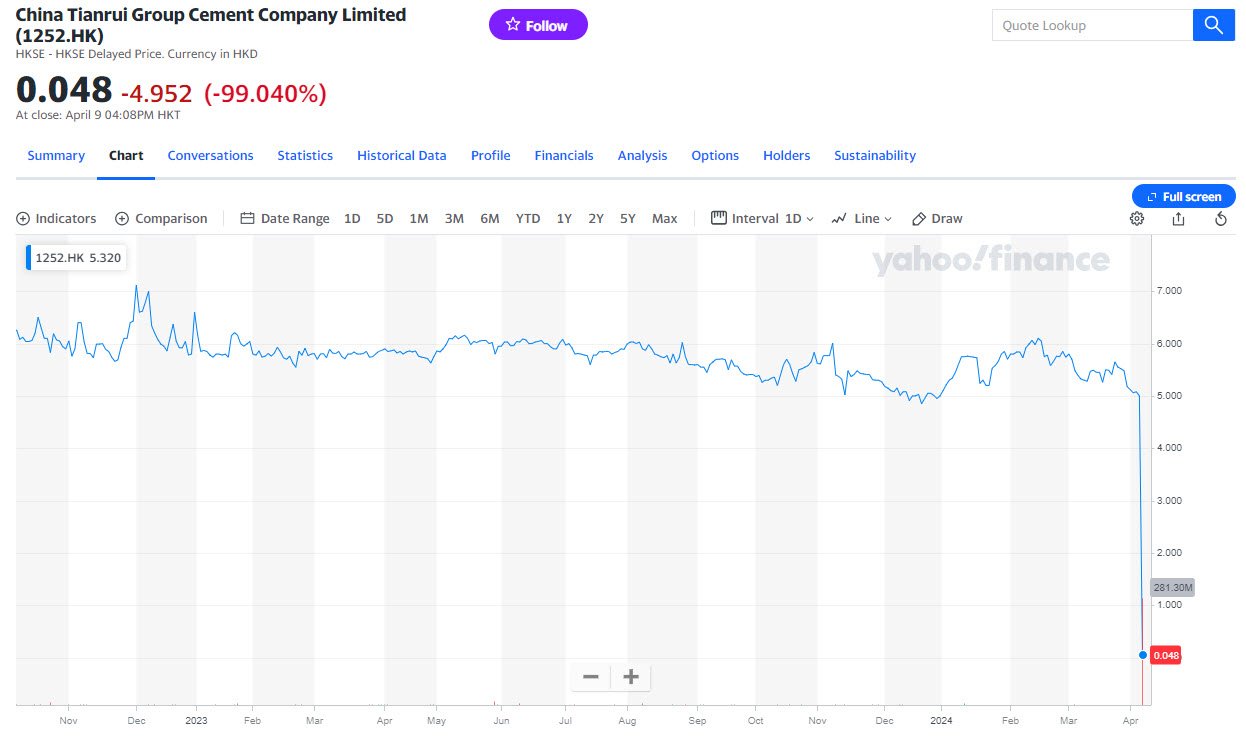

In a shocking turn of events, China Tianrui Group Cement Co., a prominent cement producer based in Henan province, suspended stock trading following a near-total wipeout of its market value. The company’s stock plummeted 99% to HK$0.05 within the final 15 minutes of trading on Tuesday, reducing its market capitalization to a mere HK$141 million ($18 million).

During the selloff, approximately 281 million shares, constituting a third of the firm’s free float, changed hands. Notably, over 80 million shares were traded during the closing auction’s final few minutes.

This dramatic stock rout serves as a stark reminder of the risks associated with obscure Chinese firms with a high concentration of shareholding. It also highlights the dangers of engaging in financing practices such as using shares as debt collateral. The company’s financial troubles are further exacerbated by the ongoing housing crisis, which is causing increased stress among China’s property developers and construction firms.

Steven Leung, executive director at UOB Kay Hian in Hong Kong, commented on the situation, stating, “When there is a relatively large selling order, it is easy to trigger panic since there are not enough buyers.”

He added that penny stocks are prone to sudden plunges given their thin liquidity and suggested that the selloff could have been triggered by margin calls if the major shareholder had pledged the stocks.

Tianrui’s controlling shareholder, Li Liufa, and his spouse jointly own approximately 70% of the company. In January, the cement producer announced that it had pledged 97 million shares, or 3.3% of its total, to secure a 12-month loan of up to 166.5 million yuan.

The company swung to a net loss of 634 million yuan ($87.7 million) last year, from a profit of 449 million yuan in 2022. It cited weak demand due to China’s property downturn, intensifying market competition, and high raw material costs as reasons for its financial woes.

Established in Hong Kong in 2011, Tianrui has an annual cement output capacity of about 58 million tons. Its business is primarily focused on central and northern China, and its products have been used in major domestic infrastructure projects such as high-speed rail lines. Despite attempts to reach out, the company’s investor relations officials have not yet responded to requests for comment.

You may also like:- The $5 Billion Blow – Short Sellers of GameStop and AMC Face Massive Losses

- SEBI Maintains Status Quo on Stock Market Timings

- Apple’s Historic $110 Billion Share Buyback

- Decline in Workforce: A Look at India’s Top 5 IT Firms in FY24

- Tesla Stock Surges Despite Worse Than Expected Earnings

- Top 10 Best Battery Companies in India

- Stocks Tumble After Hot Inflation Report – What to Expect Next

- Six Companies Correcting More Than 50% in NSE500 Stocks

- Bank of Japan Raises Interest Rates – A Historic Move

- From a Trading Genius to $17.6B Retail King – The Radhakishan Damani Story