On Tuesday, the Bank of Japan (BoJ) made a historic move by raising its interest rates for the first time since 2007. The short-term interest rates were increased to 0% to 0.1% from the previous -0.1%, marking the end of the world’s last negative interest rate.

The BoJ ended the most aggressive monetary easing program in modern history, along with its yield curve control mechanism. This move was widely expected and resulted in a weakening of the yen.

#BREAKING | BoJ ends negative interest rates

— Hyme Blogs (@HymeBlogs) March 19, 2024

Despite the rate hike, the bank stated that financial conditions would remain accommodative. This indicates that this isn’t the beginning of an aggressive tightening cycle like those seen in the US and Europe in recent years.

In addition to the rate hike, the BoJ also scrapped the yield curve control program while pledging to continue buying long-term government bonds as needed. It also ended its purchases of exchange-traded funds.

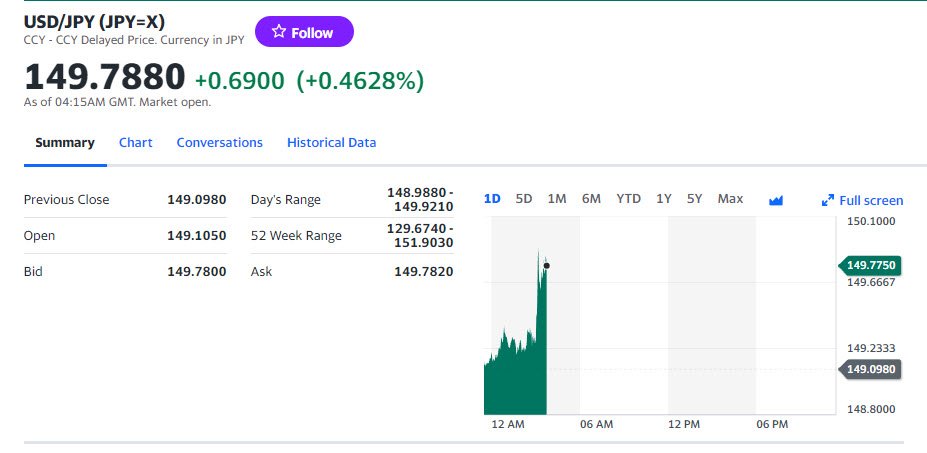

The yen fell against the dollar from 149.29 just before the announcement to as weak as 149.92 afterwards.

In ending the negative rate, Governor Kazuo Ueda made history by turning the page on the BoJ’s experimental monetary easing program. This move comes after years in which Japan’s central bank was a global outlier.

The policy gap now becomes even more stark as the BoJ makes its first upward move in close to 17 years, just as its peers around the world are considering cutting their rates after historically aggressive tightening campaigns.

The BoJ stated that its stable inflation target of 2% has come into sight as a virtuous cycle of wages feeding demand-led inflation is emerging. Rengo, Japan’s biggest umbrella group for labor unions, reported that wage talks resulted in an initial deal for 5.28% increases, the best outcome since 1991.

Some 38% of 50 economists surveyed by Bloomberg had expected the March rate liftoff, while another 54% predicted the move would come a month later. The survey was conducted before the strong results from annual wage negotiations that fueled widespread speculation the central bank wouldn’t wait.

As part of its policy shift, the central bank said it would ditch its buying of real estate investment trusts. The BoJ adopted the highly unusual measure of buying risk assets like ETFs in 2010, ultimately becoming the biggest single holder of Japanese stocks.

Governor Ueda, the first former academic to take the helm at the BoJ, had previously adjusted aspects of the ultra-easy policy settings he inherited when he became governor in April. Few analysts predicted Ueda would be able to unwind within a year so many policies that had become a headache for the central bank.

Ueda’s predecessor Haruhiko Kuroda launched a shock-and-awe stimulus bazooka in April 2013 with the aim of achieving 2% inflation in two years. As that goal stayed out of reach, Kuroda adopted the negative rate and then the YCC program in 2016.

The prolonged monetary easing led to an expansion of the BoJ’s balance sheet to the point where it’s now worth 127% of the annual economy, four times bigger than the Federal Reserve’s assets-to-economy ratio. Even so, inflation didn’t really kick in until the supply shocks triggered by Covid-19 and Russia’s war in Ukraine.

Ueda’s post-decision press conference usually begins at 3:30 p.m. in Tokyo. At that event, he will elaborate on the thinking behind Tuesday’s policy decisions.

You may also like:- 5 NISM Certifications to Boost Your Finance Career

- Overview of the Top 42 AMC Mutual Funds in India

- Top Stocks to Watch in Modi 3.0 Era

- Top Facts about GIFT NIFTY You Need To Know

- Bull Run in Indian Stock Market Post PM Modi’s Election Win

- The $5 Billion Blow – Short Sellers of GameStop and AMC Face Massive Losses

- SEBI Maintains Status Quo on Stock Market Timings

- Apple’s Historic $110 Billion Share Buyback

- Decline in Workforce: A Look at India’s Top 5 IT Firms in FY24

- Tesla Stock Surges Despite Worse Than Expected Earnings