In times of financial need, a loan against your Life Insurance Corporation (LIC) policy can be a practical solution. This process allows policyholders to leverage the value of their life insurance policy as collateral for a loan.

However, it’s important to understand the steps involved, eligibility criteria, documentation requirements, and repayment obligations before proceeding.

Here’s a comprehensive guide to help you navigate this process effectively.

Understanding Loan Against LIC Policy

A loan against an LIC policy utilizes the surrender value of the policy as security for the loan amount. The surrender value is the amount payable to the policyholder in case of policy termination before its maturity date. This type of loan offers a relatively straightforward application process and is typically available at lower interest rates compared to other types of loans.

Steps to Get Loan Against Your LIC Policy

1. Policy Eligibility Check:

Ensure that your LIC policy is eligible for a loan. Not all LIC policies allow loans, so review your policy document or contact LIC directly to confirm loan availability.

2. Loan Amount Determination:

Calculate the maximum loan amount you can avail against your policy. Generally, the loan amount is a percentage of the policy’s surrender value, which varies based on the type and duration of the policy.

3. Loan Application Process:

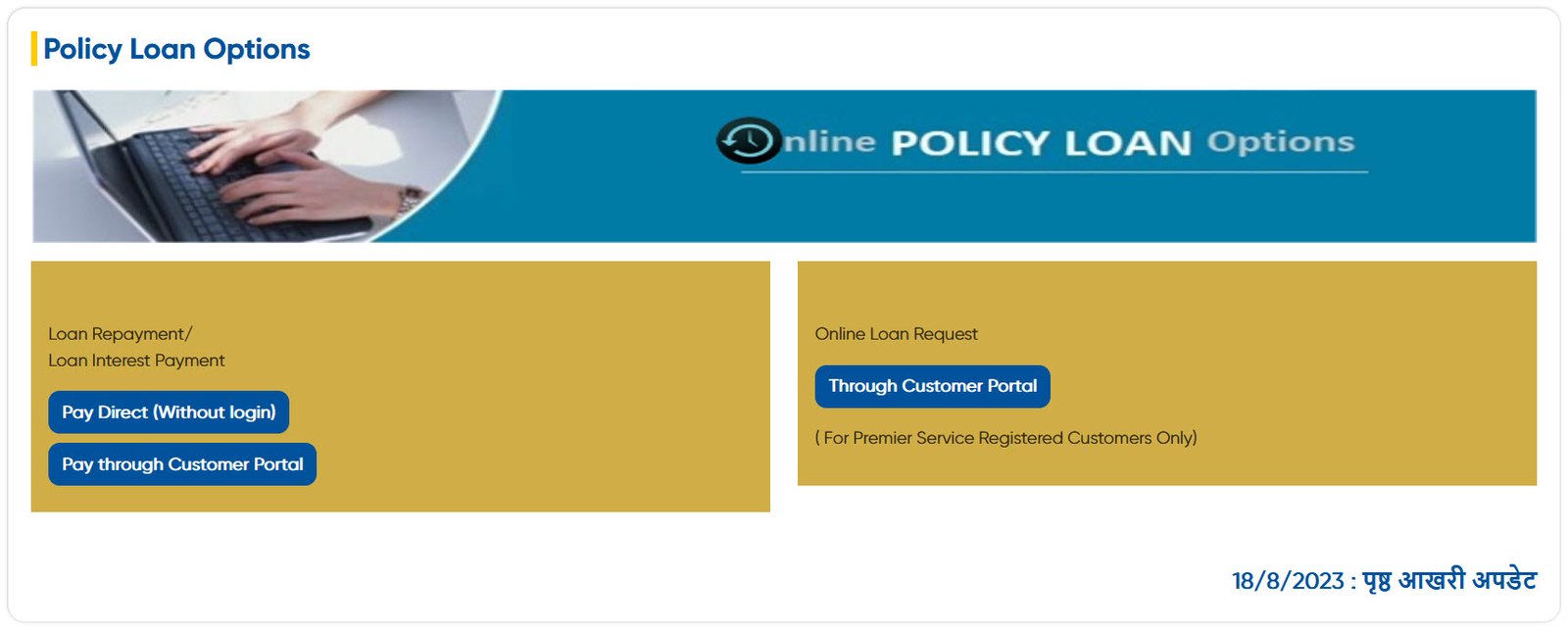

- Visit your nearest LIC branch or access the official LIC website to obtain the loan application form.

- Fill out the application form accurately, providing all required details.

4. Document Submission:

Gather the necessary documents for the loan application, including:

- Policy document

- Identification proof (Aadhaar card, PAN card, passport, etc.)

- Address proof

- Any other documents specified by LIC

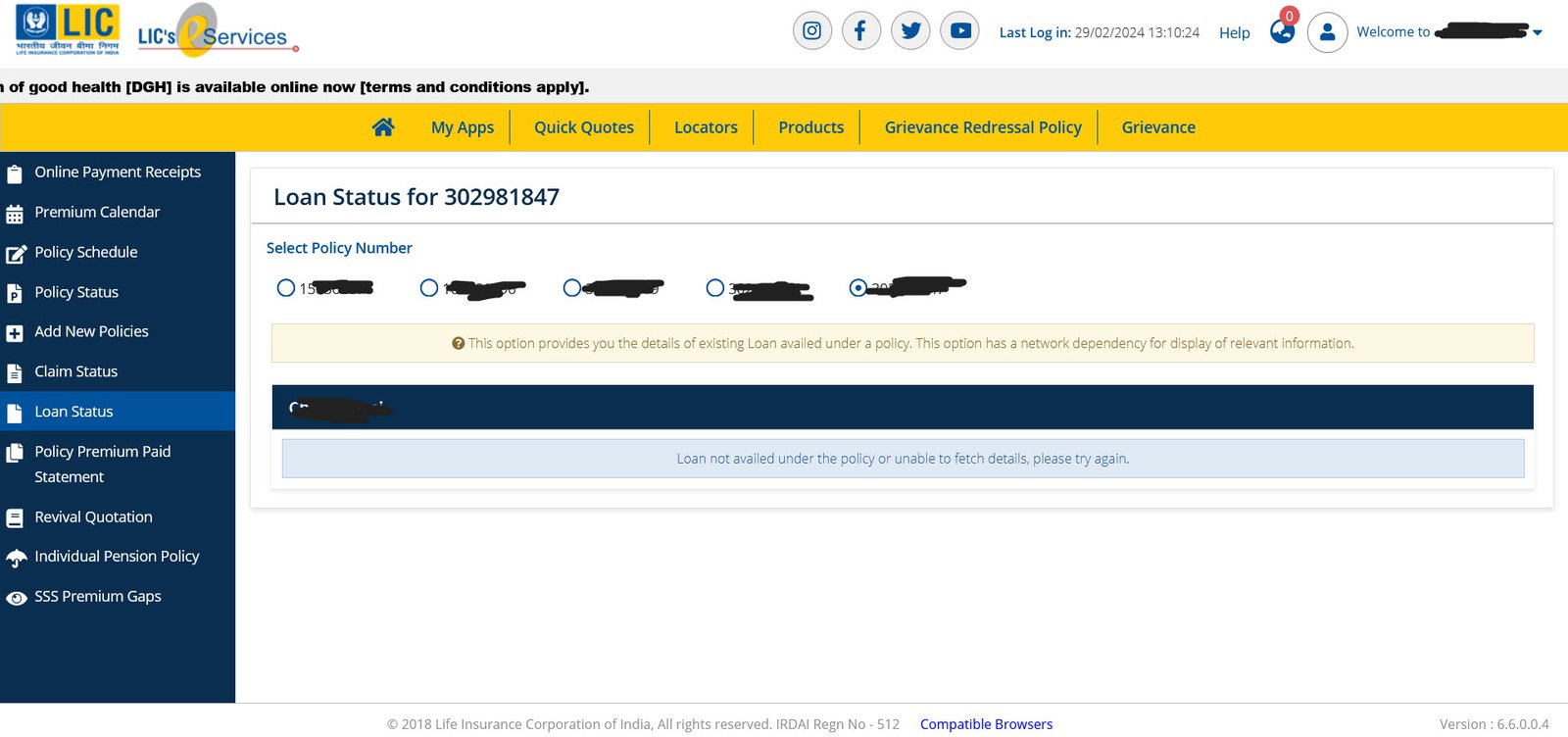

5. Loan Processing:

Submit the completed application form along with the required documents to the LIC branch office or through the online portal (if available).

LIC will verify the submitted documents and process your loan application accordingly.

6. Loan Approval and Disbursement:

Upon approval of your loan application, LIC will disburse the loan amount to you. The loan amount will be deducted from the surrender value of your policy, and interest will be charged on the loan amount.

7. Repayment Terms:

- Repay the loan amount along with the applicable interest within the specified tenure.

- Timely repayment is crucial to avoid policy lapses or reduced benefits.

- Understand the repayment schedule and terms outlined by LIC.

Important Considerations

- Loan Repayment Responsibility: Ensure that you can comfortably repay the loan amount along with the interest within the chosen tenure.

- Policy Impact: Failure to repay the loan and interest on time may lead to policy lapses or reduced benefits.

- Consultation: If you have any doubts or questions regarding the loan process, terms, or implications, consult LIC officials or financial advisors for guidance.

By following these steps and understanding the terms associated with obtaining a loan against your LIC policy, you can effectively utilize your life insurance policy to meet your financial needs while safeguarding its benefits and coverage. Always prioritize timely repayments to maintain the integrity of your LIC policy.

You may also like:- 100 Hobby Niche Ideas – A Comprehensive List

- 21 Ways to Make Money Online in 2024

- Securing Your Finances – The Evolution of Online Banking

- How We Made $10,000 Monthly With Affiliate Programs

- Top Creative Tips on Making Money

- Building a Sustainable Monthly Income Stream from Home

- How To Make $100 Per Day With Google AdSense

- Build Your Blog Into a Brand – Strategies for Freelancers

- Six Realities Every Freelancer Faces

- 10 Great Questions to Ask Your Financial Advisor