In the ever-evolving landscape of cryptocurrencies, Bitcoin remains a focal point for investors, traders, and enthusiasts. Recently, JPMorgan, a prominent financial institution, has weighed in on the future of Bitcoin’s price. Their analysis suggests that the much-anticipated halving event in April could have significant implications for the world’s most famous digital currency.

The Halving Event: What Is It?

Before exploring into JPMorgan’s predictions, let’s briefly understand what the halving event entails. Approximately every four years, the Bitcoin network undergoes a halving, which reduces the rate at which new Bitcoins are mined. During this event, the reward given to miners for validating transactions is cut in half.

Historically, halvings have acted as catalysts for price gains, but this time, the story might be different.

JPMorgan’s Perspective

JPMorgan analysts point out that the upcoming halving could lead to a chain of events that impacts Bitcoin’s price. Here are the key takeaways from their analysis:

- Reduced Miner Rewards: The halving will reduce the issuance of new Bitcoins by half. Miners, who play a crucial role in maintaining the network, will receive fewer rewards. This reduction in profitability could affect their operations.

- Higher Production Costs: As mining becomes more resource-intensive, production costs rise. JPMorgan believes that this higher cost of production could serve as a new lower boundary for Bitcoin’s price.

- Downside Risk: While past halvings have typically led to price increases, this time, JPMorgan sees a potential downside risk. Once the initial euphoria surrounding the halving subsides, the firm predicts that Bitcoin could fall as far as $42,000.

JPMorgan’s forecast centers around the Bitcoin network’s hashrate. Hashrate refers to the computational power dedicated to mining and securing the network. The firm anticipates an immediate 20% drop in hashrate after the halving. Less efficient mining rigs may exit the scene due to reduced profitability. This adjustment would bring the estimated production cost range closer to the $42,000 mark.

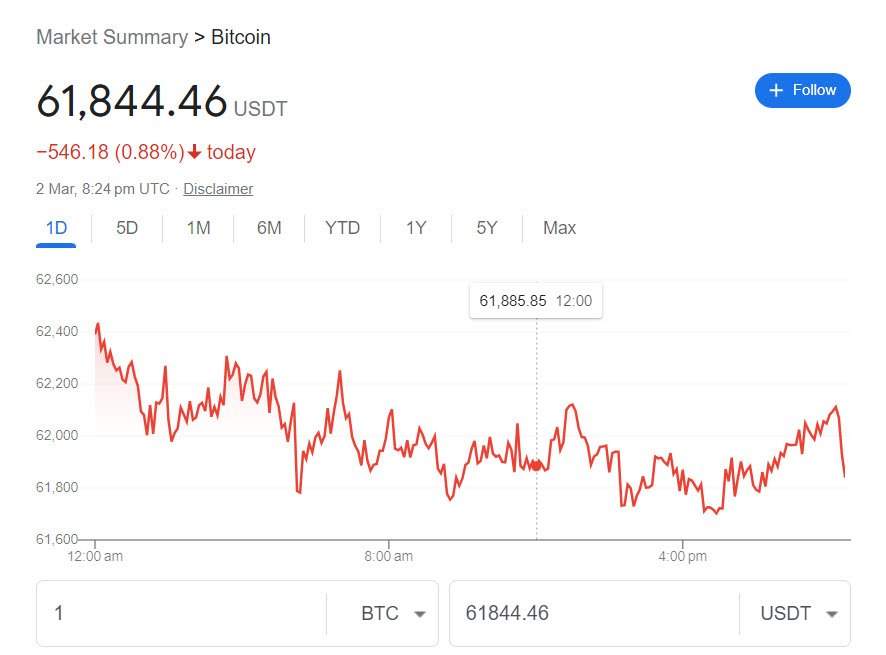

The current price of bitcoin is trading at around $61,844, according to Google results.

Despite these predictions, it’s essential to consider other factors. Bitcoin demand remains robust, especially with the recent approval of several Bitcoin exchange-traded funds (ETFs). Institutional interest continues to grow, and the accessibility of the cryptocurrency is expanding. Just last week, BlackRock’s Bitcoin ETF witnessed substantial inflows, demonstrating continued investor interest.

Conclusion

In the volatile world of cryptocurrencies, nothing is certain. JPMorgan’s cautionary outlook serves as a reminder that even a digital giant like Bitcoin can experience fluctuations. As we approach the halving event, keep an eye on the market dynamics, miner behavior, and institutional participation. Whether Bitcoin soars or corrects, one thing remains clear: the crypto landscape is always full of surprises.

Disclaimer: The information provided in this article is based on JPMorgan’s analysis and should not be considered financial advice. Always conduct your research and consult with a professional before making investment decisions.

You may also like:- Man Makes ₹100 Crore in 17 Days After Buying Hippo-Inspired Crypto Coin

- Why Is Binance Founder CZ Being Released Two Days Early?

- Hacker Steals $6M Through Massive Token Minting Exploit on Delta Prime

- eToro US Halts Most Crypto Trading After SEC Settlement

- CEX.IO Resumes UK Operations After Regulatory Halt

- Tether Acquires 9.8% Stake in Latin American Agriculture Leader Adecoagro

- Crypto Romance Scams – How They Work and How to Protect Yourself

- Analysts Caution 20% Bitcoin Decline as US Rate Cut Fuels Recession Fears

- WazirX Hacker Sends $6.5M to Tornado Cash

- Trapped in Nigeria – The Struggle of a Binance Executive Proclaiming Innocence

This Post Has 3 Comments