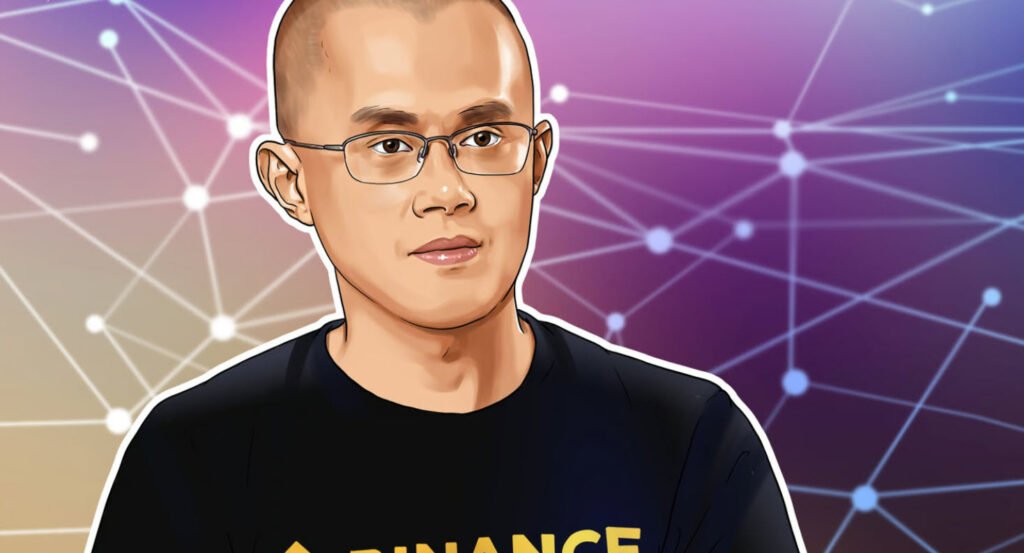

In a groundbreaking development, Changpeng Zhao, the founder of Binance, the world’s largest cryptocurrency exchange, has been sentenced to four months in prison. This sentencing comes after Zhao pleaded guilty to charges of enabling money laundering at his crypto exchange.

Changpeng Zhao, commonly known as CZ, was accused of willfully failing to implement an effective anti-money laundering program as required by the Bank Secrecy Act. He also allowed Binance to process transactions involving proceeds of unlawful activity, including between Americans and individuals in sanctions jurisdictions.

The U.S. District Judge Richard Jones credited CZ for taking responsibility for his wrongdoing. Changpeng Zhao expressed regret for his failure to implement an adequate anti-money laundering program. “I failed here,” Changpeng Zhao told the court, “I deeply regret my failure, and I am sorry”.

However, the judge was troubled by Zhao’s decision to ignore U.S. banking requirements that would have slowed the company’s explosive growth. “Better to ask for forgiveness than permission,” is what Changpeng Zhao told his employees about the company’s approach to U.S. law, prosecutors said.

The sentence, which included a previously agreed-to $50 million fine, was far less than the three years the Justice Department had sought. Zhao is the first person ever sentenced to prison time for such violations of the Bank Secrecy Act.

This case marks a significant moment in the crypto industry, highlighting the importance of adhering to regulatory requirements. It serves as a reminder that no person, regardless of wealth, is immune from prosecution or above the laws of the United States.

Despite the setback, Changpeng Zhao is already planning out his future projects. As part of the settlement, Changpeng Zhao stepped down as the company’s CEO. Though he is no longer running the company, Zhao is widely reported to have an estimated 90% stake in Binance.

This development underscores the need for transparency and adherence to regulatory norms in the rapidly evolving crypto industry. It remains to be seen how this event will impact Binance’s operations and the broader cryptocurrency market.