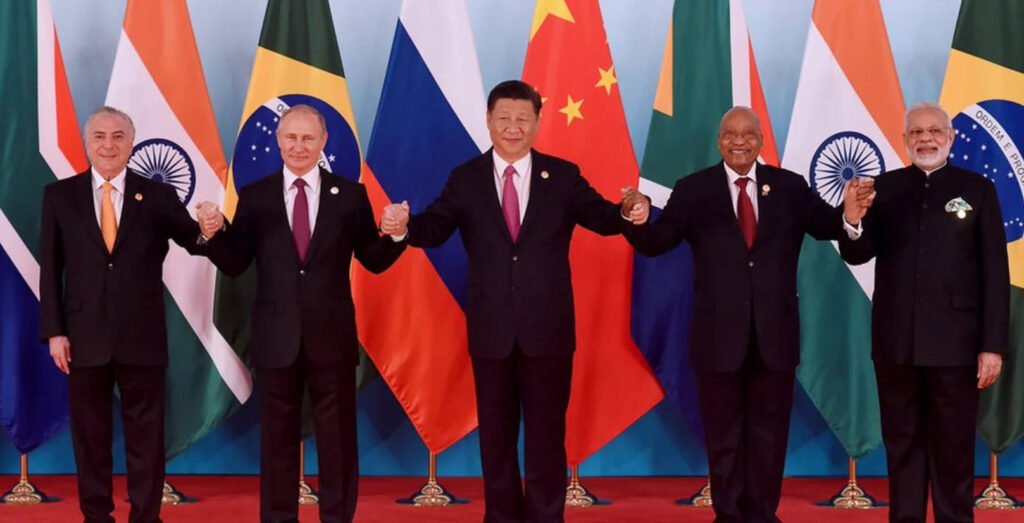

The BRICS (Brazil, Russia, India, China, and South Africa) group is making significant strides toward reducing its reliance on the U.S. dollar in international settlements. As part of this effort, BRICS is set to create an independent payment system based on cryptocurrency and blockchain technologies.

Let’s explore into the details of this groundbreaking initiative.

The Need for an Alternative Payment System

For some time now, BRICS has been exploring ways to diversify its financial transactions away from the dominant U.S. dollar. The existing global monetary system heavily relies on the dollar for trade settlements, which can lead to vulnerabilities and geopolitical implications. By developing an independent payment system, BRICS aims to achieve several key objectives:

1. Reducing Dollar Dependence: The BRICS grouping seeks to minimize its reliance on the U.S. dollar, thereby enhancing its financial sovereignty and resilience.

2. Efficiency and Cost-Effectiveness: The new payment system will leverage state-of-the-art tools such as blockchain and digital technologies. It aims to be convenient for governments, businesses, and common people while remaining cost-effective.

3. Geopolitical Neutrality: By sidestepping political considerations, the BRICS payment system intends to foster fair and transparent financial interactions.

The Role of Cryptocurrency and Blockchain

The heart of this payment system lies in blockchain technology. Blockchain ensures secure, transparent, and tamper-proof transactions. Each transaction is recorded in a decentralized ledger accessible to all participants, eliminating the need for intermediaries.

While the specific cryptocurrency(s) to be used have not been explicitly mentioned, it’s likely that BRICS will explore stablecoins or central bank digital currencies (CBDCs). These digital assets can facilitate cross-border transactions efficiently.

Implementation Challenges

Creating an independent payment system is no small feat. BRICS faces several challenges:

1. Technical Infrastructure: Developing a robust blockchain infrastructure that can handle high transaction volumes and maintain security is crucial.

2. Interoperability: Ensuring compatibility with existing payment systems and international standards is essential for seamless cross-border transactions.

3. Regulatory Coordination: Harmonizing regulations across BRICS nations will be necessary to avoid legal hurdles.

The BRICS payment system could significantly impact the global financial landscape:

1. De-Dollarization: By providing an alternative to the dollar-dominated system, BRICS contributes to the ongoing trend of de-dollarization.

2. Trade Facilitation: Businesses within BRICS countries will benefit from streamlined cross-border payments, enhancing trade efficiency.

3. Geopolitical Shifts: The system’s success could alter the balance of financial power, challenging the dollar’s supremacy.

In conclusion, BRICS’ move toward an independent payment system based on cryptocurrency and blockchain reflects its commitment to financial autonomy and innovation. As the world watches, this initiative may reshape the future of international finance.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Readers are encouraged to conduct their research and consult with financial professionals before making any decisions.

You may also like:- Man Makes ₹100 Crore in 17 Days After Buying Hippo-Inspired Crypto Coin

- Why Is Binance Founder CZ Being Released Two Days Early?

- Hacker Steals $6M Through Massive Token Minting Exploit on Delta Prime

- eToro US Halts Most Crypto Trading After SEC Settlement

- CEX.IO Resumes UK Operations After Regulatory Halt

- Tether Acquires 9.8% Stake in Latin American Agriculture Leader Adecoagro

- Crypto Romance Scams – How They Work and How to Protect Yourself

- Analysts Caution 20% Bitcoin Decline as US Rate Cut Fuels Recession Fears

- WazirX Hacker Sends $6.5M to Tornado Cash

- Trapped in Nigeria – The Struggle of a Binance Executive Proclaiming Innocence

This Post Has 5 Comments