Trading in the financial markets is a dynamic and complex endeavor that requires a comprehensive understanding of various factors. One approach that has gained popularity among experienced traders is price action trading.

This strategy involves analyzing the price movement of an asset without relying on complex indicators or oscillators. Instead, price action traders focus on interpreting the raw price data to make informed trading decisions.

Also Read: Stock Market Books

In this article, we will explore 10 price action secrets that can help you master trading like a pro.

1. Support and Resistance as Areas of Value

Support and resistance levels are foundational concepts in price action trading. These levels indicate areas where the price has historically shown a tendency to reverse or stall. Price action traders recognize these levels as areas of value, where potential buying or selling opportunities may arise. Trading around these levels can provide favorable risk-reward ratios and enhance the probability of successful trades.

2. Avoid Trading Far from EMA (Exponential Moving Average)

The Exponential Moving Average (EMA) is a widely used tool in technical analysis. Price action traders pay attention to the relationship between price and the EMA. When the market deviates significantly from the EMA, it suggests a potential overextension. Trading in such conditions can be risky, as it increases the likelihood of price reverting back to the EMA. By avoiding trades when the market is far from the EMA, traders can manage risk more effectively.

3. Trading Near Support/Resistance Levels for Optimal Risk-Reward Ratio

Trading in proximity to support and resistance levels can offer attractive risk-reward ratios. These levels often act as barriers that the price must overcome. By entering trades near these levels, traders can place stop-loss orders relatively close to their entry points, resulting in favorable risk-reward ratios. This approach becomes particularly potent in ranging markets, where price oscillates between well-defined support and resistance zones.

4. Identifying the End of a Trend with Moving Averages

Moving averages play a pivotal role in detecting potential trend reversals. Price action traders observe the behavior of price in relation to moving averages to gauge the strength and direction of a trend. A change in the slope or a crossover of moving averages can indicate a potential trend shift, helping traders identify when a trend might be coming to an end.

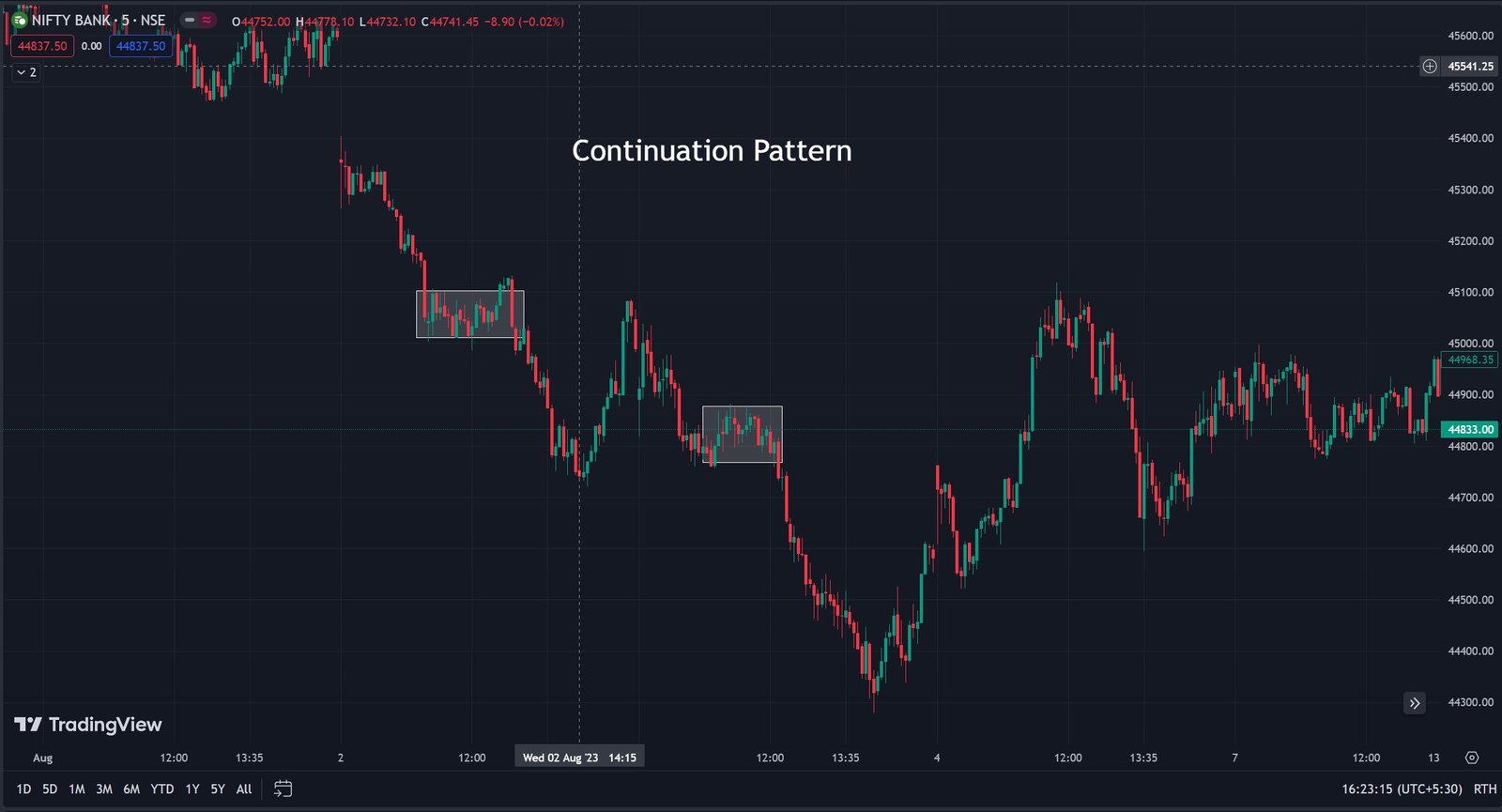

5. Harnessing Continuation Patterns in Trending Markets

Continuation patterns, such as flags, pennants, and triangles, offer traders valuable insights in trending markets. These patterns signal temporary pauses or consolidations within a larger trend. Price action traders take advantage of these patterns by entering trades in the direction of the prevailing trend once the continuation pattern is confirmed. This strategy capitalizes on the momentum of the ongoing trend.

6. Maximizing Profits by Trading with the Trend

Trading with the trend is a fundamental principle in price action trading. Trends tend to persist, and trading in the direction of the trend can lead to substantial profits. Price action traders focus on identifying higher highs and higher lows in an uptrend and lower highs and lower lows in a downtrend. By aligning trades with the predominant trend direction, traders increase the likelihood of successful outcomes.

7. Seizing Opportunities from False Breakouts

False breakouts occur when price briefly moves beyond a support or resistance level but quickly reverses. Price action traders view these scenarios as prime opportunities for trading. The rapid reversal following a false breakout often results in a strong price movement in the opposite direction. Recognizing false breakouts and positioning trades accordingly can lead to profitable outcomes.

8. Unveiling Hidden Support/Resistance Levels with Big Bars

Wide-range candles, also known as big bars, can serve as hidden support or resistance levels. These candles often signify significant market sentiment shifts and can act as barriers that influence future price movement. Price action traders keep an eye on big bars and monitor how price interacts with them, as they can provide valuable clues about potential reversals or continuations.

9. Explosive Moves Following Narrow Range Candles

Narrow range candles indicate a period of reduced price volatility and potential accumulation or distribution. Price action traders anticipate that these periods of consolidation will be followed by explosive price moves. The breakout from a narrow range pattern can lead to strong and sustained trends, making this pattern a valuable tool for identifying high-potential trade setups.

10. The Relationship Between Range and Trend Duration

Price action traders understand that market behavior follows cycles of range-bound consolidation and trending movement. The longer a market remains in a range-bound state, the more significant the potential trend that may follow once a breakout occurs. This principle applies to various types of markets, and recognizing the interplay between consolidation and trending phases can aid traders in making well-timed decisions.

In conclusion, mastering price action trading requires a deep understanding of how price behaves and reacts in different market conditions. By incorporating these 10 price action secrets into your trading approach, you can enhance your ability to analyze price charts effectively, identify high-probability trade setups, and make informed decisions that align with the underlying market dynamics.

Remember that successful price action trading takes time, practice, and continuous learning, but the rewards can be well worth the effort.

Follow @AsthaTrade for more stock related tips.

Pingback: Toncoin (TON) Drops 17% as Telegram Co-Founder Gets Arrested in France - Online Hyme