A look at the major stock market downturns that shaped India’s financial history.

India’s stock market has experienced several dramatic crashes over the decades each triggered by unique economic events, policy decisions, or global shocks. While markets eventually recovered, these periods tested investor confidence and reshaped financial regulations.

Here’s a closer look at the biggest Indian market crashes and what caused them.

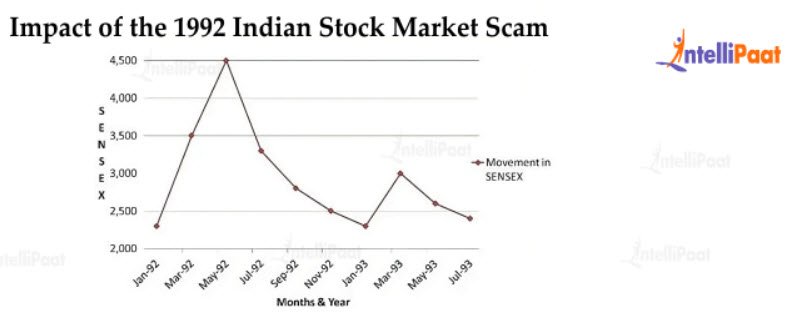

1. Harshad Mehta Scam (1992) (-53%)

The 1992 crash remains one of the most shocking episodes in Indian financial history. Stockbroker Harshad Mehta exploited loopholes in the banking system to artificially inflate share prices, creating a massive bull run. When the scam was exposed, the market collapsed sharply, wiping out billions in investor wealth.

This crisis exposed weaknesses in market regulation and led to stronger oversight by the Securities and Exchange Board of India (SEBI). It also changed how investors viewed leverage and speculative trading.

2. Dot-Com Bubble Burst (2000) (-20%)

During the late 1990s, technology stocks soared as investors bet heavily on internet-based companies. Indian IT giants gained global attention, and valuations surged rapidly. However, when the global dot-com bubble burst, Indian markets also felt the shock.

Although the fall was less severe compared to other crashes, tech-heavy portfolios took a significant hit. Many investors learned a harsh lesson about hype-driven investing.

3. Global Financial Crisis (2008) (-60%)

The 2008 Global Financial Crisis triggered one of the steepest declines in Indian market history. Originating from the U.S. housing market collapse, the crisis caused global liquidity to dry up. Foreign investors pulled money out of emerging markets, including India.

The Sensex lost around 60% from its peak, and panic selling dominated trading floors. Despite India’s relatively strong banking system, the global contagion hit sentiment hard.

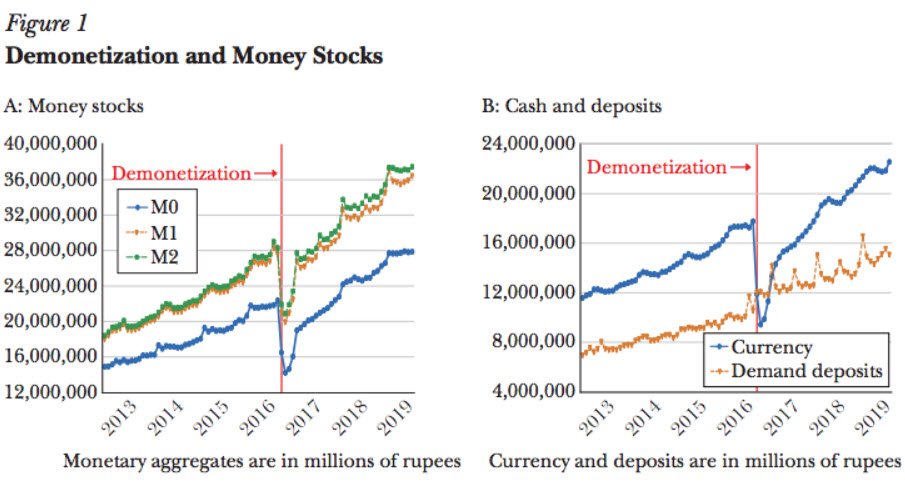

4. Demonetization Shock (2016) (-6%)

In November 2016, India’s sudden demonetization policy disrupted liquidity across the economy. Markets reacted with volatility as investors worried about the impact on consumption, small businesses, and GDP growth.

Compared to other crashes, the decline was relatively mild, but certain sectors especially real estate, FMCG, and small-cap stocks saw noticeable corrections.

5. COVID-19 Crash (2020) (-38%)

The COVID-19 pandemic caused one of the fastest market crashes ever recorded. As lockdowns began worldwide in early 2020, uncertainty about the economy triggered massive selling. Indian indices plunged nearly 38% within weeks.

However, aggressive global stimulus, low interest rates, and the rise of retail investing led to a surprisingly fast recovery turning the crash into a historic V-shaped rebound.

Conclusion

Every market crash tells a story of excess optimism, sudden shocks, or structural change. From the Harshad Mehta scam to the COVID-19 panic, Indian markets have repeatedly demonstrated resilience. Over time, regulations improved, investor awareness increased, and technology transformed trading practices.

For investors, the biggest lesson is clear: market crashes are painful but temporary. History shows that while downturns are inevitable, disciplined investing and long-term vision often turn crises into opportunities.