Cryptocurrency trading has grown in popularity, and many traders rely on technical analysis to make informed decisions. Technical analysis involves studying past market data, mainly price and volume, to predict future price movements. To succeed in crypto trading, it is essential to use the right indicators and tools.

This article explores the best crypto indicators and tools for technical analysis, helping both beginners and experienced traders make better decisions.

What is Technical Analysis?

Technical analysis (TA) is a method used to evaluate financial markets by analyzing statistical trends from trading activity. It helps traders predict future price movements based on historical price patterns. Unlike fundamental analysis, which focuses on a cryptocurrency’s intrinsic value, technical analysis focuses solely on price action and volume.

Best Crypto Indicators for Technical Analysis

Technical indicators help traders analyze price trends, momentum, and market volatility. Here are some of the most effective indicators used in crypto trading:

1. Moving Averages (MA & EMA)

Moving averages smooth out price data to help traders identify trends over time. There are two main types:

- Simple Moving Average (SMA): Calculates the average price over a set period.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to price changes.

A common strategy is the Golden Cross and Death Cross method:

- Golden Cross: When a short-term moving average crosses above a long-term moving average, signaling a potential uptrend.

- Death Cross: When a short-term moving average crosses below a long-term moving average, signaling a potential downtrend.

2. Relative Strength Index (RSI)

The RSI measures the speed and change of price movements to determine if a crypto asset is overbought or oversold.

- An RSI above 70 suggests the asset is overbought and may experience a price drop.

- An RSI below 30 suggests the asset is oversold and may experience a price rise.

RSI is useful for identifying entry and exit points in a volatile crypto market.

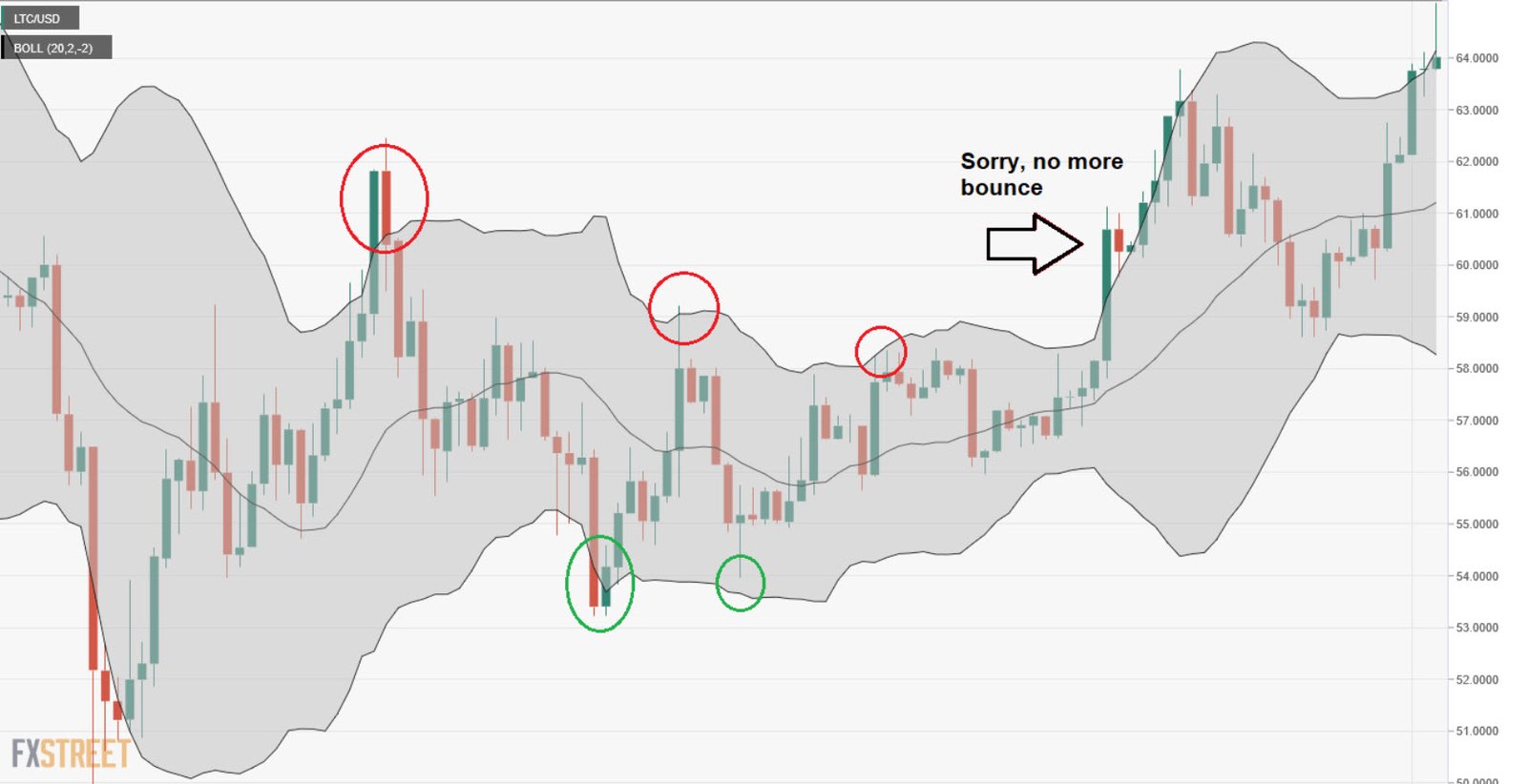

3. Bollinger Bands

Bollinger Bands consist of three lines:

- A middle line (SMA)

- An upper band (SMA + standard deviation)

- A lower band (SMA – standard deviation)

When price touches the upper band, the asset may be overbought, signaling a potential sell opportunity. When it touches the lower band, the asset may be oversold, signaling a potential buy opportunity.

4. Moving Average Convergence Divergence (MACD)

The MACD is a momentum indicator that shows the relationship between two moving averages:

- When the MACD line crosses above the signal line, it indicates a bullish signal.

- When the MACD line crosses below the signal line, it indicates a bearish signal.

MACD helps traders spot trend reversals and confirm price trends.

5. Fibonacci Retracement

Fibonacci retracement levels help identify potential support and resistance levels. The key levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%. Traders use these levels to predict price pullbacks before continuing in the trend direction.

For example, if Bitcoin is on an uptrend and retraces to the 61.8% Fibonacci level before moving higher, traders may see this as a buying opportunity.

6. Volume Indicator

Volume plays a crucial role in confirming trends and price movements.

- If price increases with high volume, the trend is strong.

- If price increases with low volume, the trend may be weak and unsustainable.

Popular volume indicators include On-Balance Volume (OBV) and Volume Weighted Average Price (VWAP).

Best Crypto Tools for Technical Analysis

Apart from indicators, traders use specialized tools and platforms to analyze the market effectively. Here are some of the best tools available:

1. TradingView

TradingView is one of the most popular charting tools for crypto traders. It provides:

- Interactive charts with multiple indicators.

- Customizable alerts and signals.

- A social platform where traders share analysis and strategies.

2. CoinMarketCap and CoinGecko

These platforms provide real-time market data, including:

- Crypto prices.

- Market capitalization.

- Trading volume.

- Historical data.

They are useful for fundamental and technical analysis.

3. Crypto Screener Tools (CryptoPanic, Coinigy, 3Commas)

Crypto screeners help traders filter assets based on technical criteria. For example:

- CryptoPanic provides news aggregation and sentiment analysis.

- Coinigy offers advanced charting and portfolio management.

- 3Commas provides automated trading strategies based on technical indicators.

4. Binance and Bybit Charting Tools

Most major crypto exchanges, including Binance, Bybit, and Kraken, provide built-in charting tools with technical indicators. These tools are useful for quick analysis while trading on the exchange.

5. Glassnode and Santiment

For on-chain analysis, Glassnode and Santiment provide data such as:

- Whale movements (large crypto transactions).

- Exchange inflows and outflows.

- Network activity and social sentiment.

On-chain analysis helps traders understand market trends beyond price charts.

Conclusion

Technical analysis is a powerful approach to crypto trading, helping traders make informed decisions based on market data. By using key indicators like moving averages, RSI, MACD, and Fibonacci retracement, traders can better predict price movements. Moreover, tools like TradingView, CoinMarketCap, and Binance charting provide valuable insights for market analysis.

However, no indicator is 100% accurate. It is always recommended to combine multiple indicators and use proper risk management strategies. Whether you are a beginner or an experienced trader, mastering these indicators and tools will improve your trading performance and help you navigate the volatile crypto market successfully.