What unfolded today across global financial markets is being described by traders and analysts as a once-in-a-decade event – a sudden, synchronized sell-off that erased trillions of dollars in value within just one hour.

Markets were relatively stable until the U.S. trading session opened. That calm did not last long.

Bitcoin ($BTC) was the first major asset to crack, triggering a wave of panic selling. As crypto prices fell, the shock quickly spread to traditional and alternative asset classes, setting off one of the most intense one-hour drawdowns seen in years.

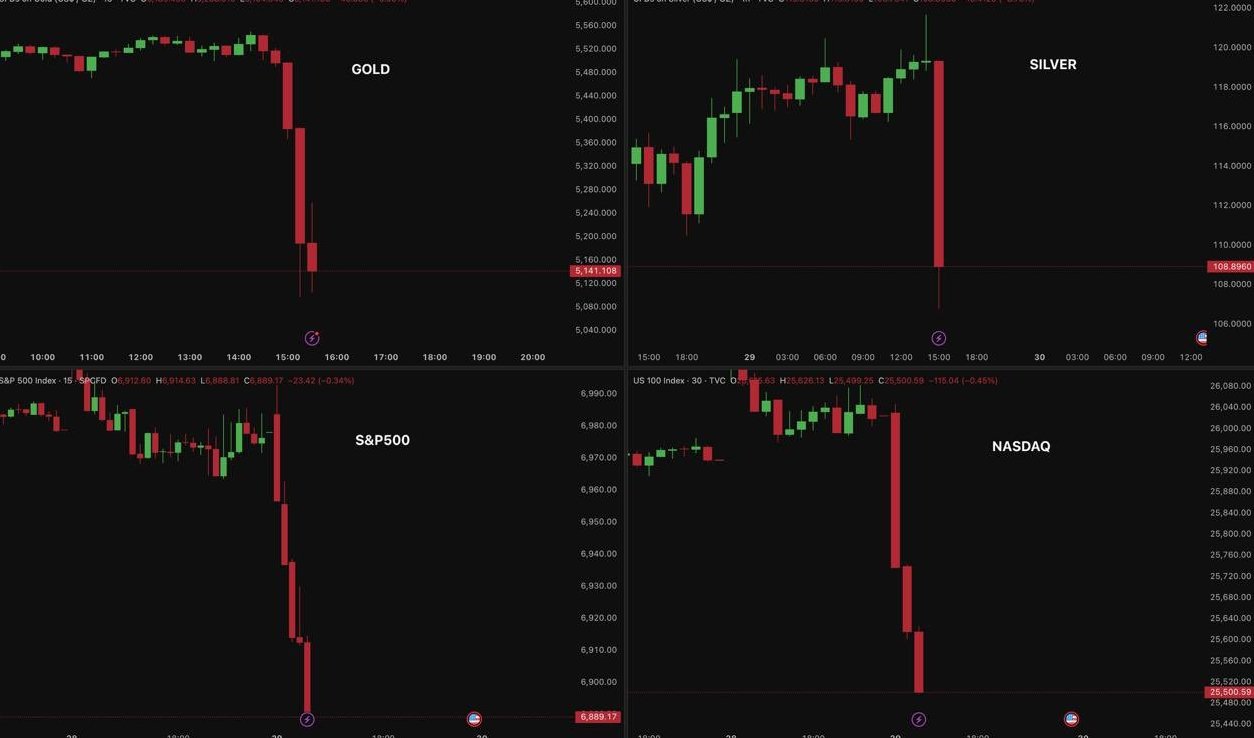

In a span of roughly 60 minutes, losses piled up at an extraordinary pace:

- Gold plunged 8%, wiping out nearly $3.1 trillion in market value

- Silver crashed 12%, erasing around $700 billion

- S&P 500 fell 1.3%, translating to about $800 billion in losses

- Crypto market capitalization dropped by approximately $110 billion

Altogether, more than $5 trillion vanished across these markets in just one hour – an amount comparable to the combined GDP of countries like Russia and Canada.

What Triggered the Collapse?

The sell-off did not have a single cause. Instead, multiple stress points collided at once.

1. Leverage Blow-Ups in Gold and Silver

Precious metals were heavily exposed to leveraged positions, especially from retail traders who had rushed in during recent highs. As prices began to fall, margin calls and forced liquidations kicked in, accelerating losses at a brutal speed. What started as a dip quickly turned into a cascade.

2. Geopolitical Fears Hit Risk Assets

For crypto and stocks, the main catalyst was rising geopolitical tension specifically concerns around U.S.-Iran escalation. Reports that the USS Abraham Lincoln had gone dark, a move often interpreted as operational secrecy, added fuel to market anxiety and risk-off sentiment.

When geopolitical uncertainty spikes, investors tend to exit volatile assets first and that is exactly what happened.

Market corrections are common. What made today different was the speed, scale, and cross-asset impact. Rarely do gold, silver, equities, and crypto all experience such sharp losses simultaneously within such a short time frame.

This event exposed:

- The dangers of excessive leverage

- How quickly retail FOMO can reverse into panic

- The market’s extreme sensitivity to geopolitical risk

- The tight interconnectedness of global asset classes

Today’s crash will likely be studied for years – as a reminder of how fast confidence can evaporate and how fragile markets become when leverage, speculation, and global tensions collide.

Whether this marks a temporary shock or the beginning of a broader trend remains to be seen. But one thing is clear: what happened today will be remembered for a long time in financial history.

Pingback: Why Bitcoin Fell Relentlessly from $126,000 to $60,000 – Online Hyme