The global financial markets are about to enter a new chapter. After nearly two years of aggressive monetary tightening, market watchers anticipate that Federal Reserve Chair Jerome Powell will soon pivot toward interest rate cuts. If history is any guide, this shift could be rocket fuel for risk assets like stocks, precious metals and most notably, cryptocurrencies.

For the past two years, higher interest rates have acted as a headwind for risk assets. Elevated borrowing costs reduce speculative demand, squeeze liquidity, and favor safe, yield-generating assets like U.S. Treasuries.

When Jerome Powell finally signals the start of a rate-cut cycle, the restraining forces vanish. Liquidity floods back into global markets. Investors search for higher returns. And the most asymmetric opportunities often lie in digital assets.

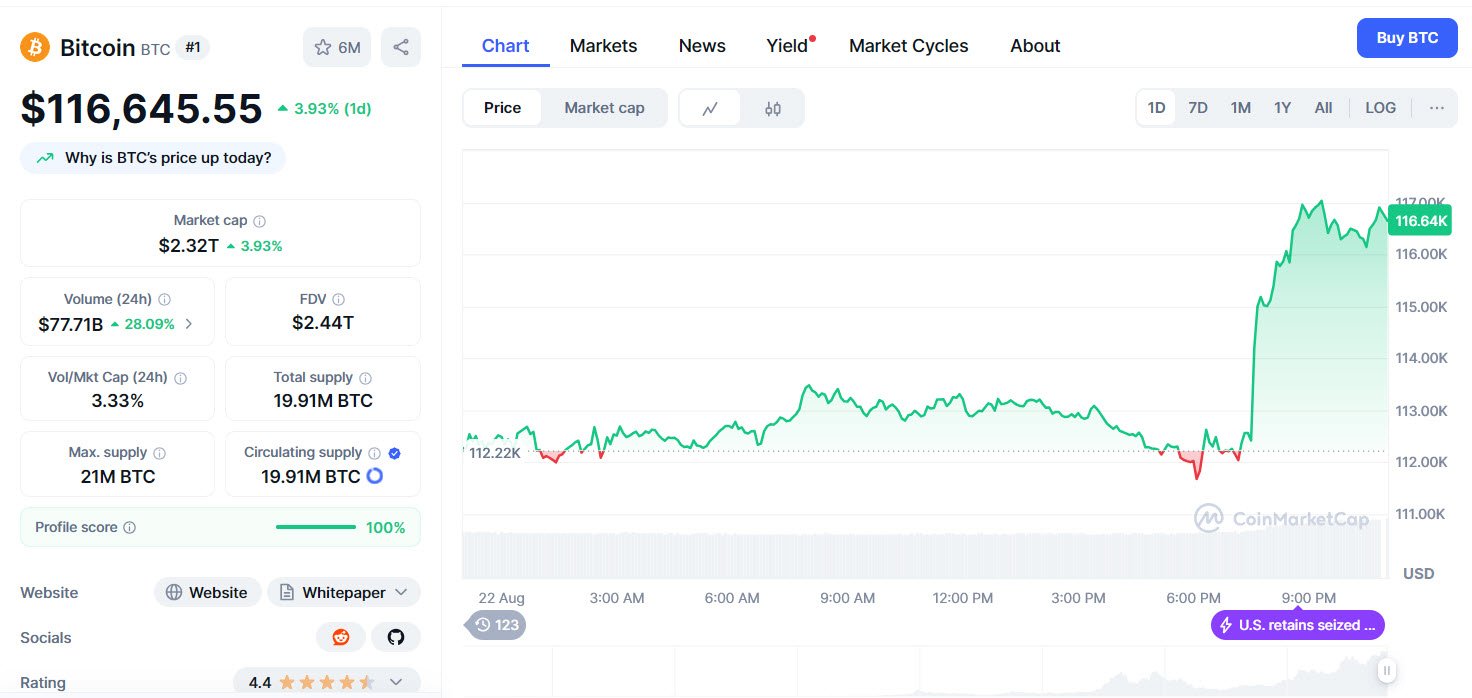

Bitcoin is often referred to as “digital gold,” but in reality, it is far more sensitive to liquidity than traditional safe havens. Past cycles show a clear trend:

- In 2020, aggressive Fed stimulus accelerated Bitcoin’s surge from under $10,000 to $69,000 in just over a year.

- Each previous halving cycle (2013, 2017, 2021) has seen new all-time highs when combined with dovish monetary policies.

This time, with institutional adoption at unprecedented levels—thanks to spot Bitcoin ETFs, major banks offering custody, and sovereign interest, Bitcoin’s upside could dwarf all previous cycles.

A realistic short-term outlook points toward $170,000 per BTC, in line with stock-to-flow models, adoption curves, and historic post-halving multipliers.

If Bitcoin is the global reserve asset of crypto, Ethereum is its digital economy. The coming cycle will likely see Ethereum outperform in relative terms, particularly as:

- Layer-2 scaling solutions (Optimism, Arbitrum, zkSync) reduce network costs.

- Institutional adoption of Ethereum-based assets (like tokenized bonds, CBDCs, and real-world assets) accelerates.

- Staking yields continue to attract capital, making Ether a crypto-native “yield-bearing” asset.

Given these factors, Ethereum reclaiming a dominant position near $7,000 in a favorable liquidity environment is entirely plausible.

While Bitcoin and Ethereum are blue-chip plays, the real speculative fire often erupts in the altcoin market. Rate cuts mean capital flows deeper into high-risk assets, and crypto’s history has repeatedly confirmed that small-cap altcoins see the most dramatic price explosions.

Key categories to watch:

- Gaming & Metaverse tokens as Web3 adoption expands.

- AI + blockchain projects aligning with broader tech trends.

- Decentralized Finance (DeFi) protocols that capture on-chain liquidity.

- Interoperability plays enabling cross-chain communication.

Historically, select altcoins have delivered 50x–100x returns in bull runs. While this space is highly speculative and risky, the opportunity set will be unmatched once Powell opens the liquidity floodgates.

The Bottom Line

The Federal Reserve’s pivot to cutting rates will mark the start of a new liquidity cycle. In such an environment:

– Bitcoin could march toward $170,000, cementing its role as a global macro asset.

– Ethereum may surge to $7,000, driven by utilization, staking, and institutional adoption.

– Altcoins could deliver life-changing returns for investors positioned early.

As always, timing and risk management are critical in crypto. Yet one thing seems clear: the next great bull cycle will begin not with a halving, nor with an ETF approval, but with Jerome Powell’s first interest rate cut.