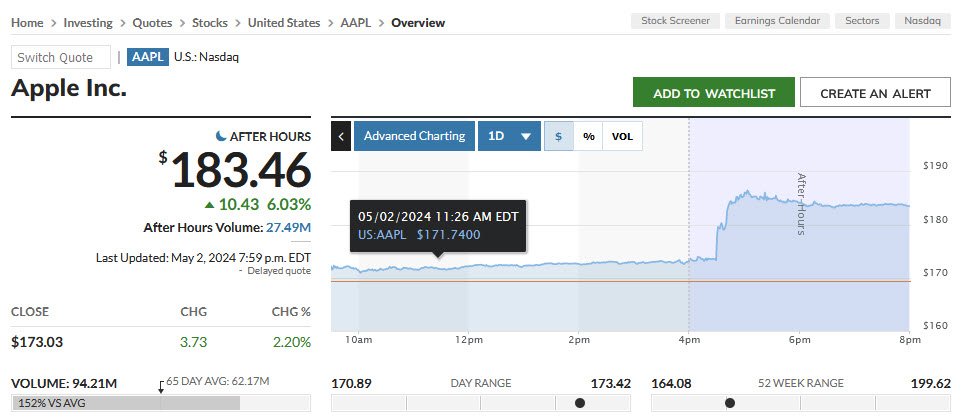

In an unprecedented move, Apple Inc. has announced a colossal $110 billion share buyback program, setting a new record for the largest share repurchase in U.S. history. This strategic decision comes as the tech giant’s second-quarter earnings and forecasts surpassed estimates, propelling its share price up by 6%.

The announcement marks a significant increase from Apple’s previous record of a $100 billion buyback in 2018, underscoring the company’s robust financial position and commitment to returning value to its shareholders. The buyback is a clear signal that Apple is transitioning from a high-growth entity to a value stock, focusing on shareholder returns rather than solely on expansion and research and development.

Apple’s share repurchase program is part of a broader financial strategy that includes a 4% increase in its cash dividend, reflecting the company’s confidence in its ongoing profitability and cash flow generation. The move is expected to add more than $190 billion in market value if the post-market trading gains continue.

This strategic buyback also reflects a broader trend in the tech industry, where companies are increasingly using their cash reserves to buy back shares, thereby boosting earnings per share and shareholder value. Apple’s decision is particularly noteworthy as it comes at a time when the company’s shares have underperformed compared to its peers, with a 10% decline year-to-date.

In conclusion, Apple’s record-breaking $110 billion share buyback is a testament to the company’s enduring financial strength and its focus on maximizing shareholder returns. As the largest buyback in U.S. history, it sets a new benchmark for corporate financial strategies and highlights the tech giant’s confidence in its future growth prospects.