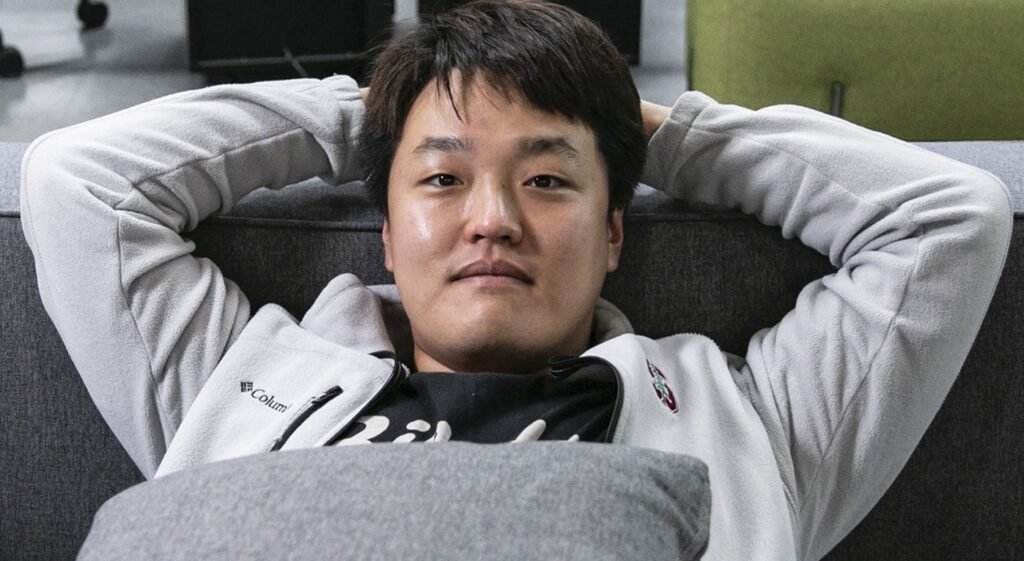

Do Kwon, the founder of Terraform Labs and creator of the TerraUSD and Luna cryptocurrencies, has been sentenced in New York to 15 years in federal prison for fraud and related offenses tied to the 2022 collapse of his crypto ecosystem, which wiped out over 40 billion dollars in market value. The sentence exceeds the 12-year term requested by U.S. prosecutors and reflects what the judge described as an unusually serious case of financial deception affecting investors worldwide.

Terraform Labs, co-founded by South Korean entrepreneur Do Kwon, promoted TerraUSD (UST) as a “stablecoin” designed to maintain a one‑dollar value via an algorithmic link to its sister token, Luna. At their peak in early 2022, the Terra ecosystem was central to the crypto market, attracting tens of billions of dollars from retail and institutional investors who believed the technology offered a relatively stable yield-bearing asset.

In May 2022, UST lost its peg and entered a death spiral with Luna, causing a rapid collapse that erased more than 40 billion dollars of value in just days and triggered a broader wave of failures across the digital asset sector. This crash devastated hundreds of thousands of investors globally and became one of the defining events of the 2022 crypto downturn.

U.S. prosecutors in the Southern District of New York charged Do Kwon in early 2025 with multiple counts, including securities fraud, wire fraud, commodities fraud, and conspiracy to commit money laundering, alleging that he built Terraform’s business on systematic misrepresentations. Authorities said he falsely portrayed TerraUSD as a reliably stable asset and misled investors about real-world adoption of the Terraform blockchain by claiming major payment partners and transaction volumes that did not actually exist at the scale he advertised.

A central allegation concerned how UST’s dollar peg was restored during a 2021 de‑pegging event: prosecutors said Do Kwon secretly enlisted a high‑frequency trading firm to buy large amounts of UST to prop up its price, while publicly attributing the recovery to the Terra algorithm alone. In August 2025, Do Kwon pleaded guilty to two counts, conspiracy to defraud and wire fraud, admitting in court that he made false and misleading statements about the stability mechanisms of UST and the role of outside trading support.

U.S. District Judge Paul A. Engelmayer in Manhattan imposed a 15-year prison term, describing his conduct as fraud on a massive and generational scale that inflicted staggering losses and shattered trust in digital asset markets. The judge noted that although prosecutors had recommended a 12‑year sentence under a plea agreement, a longer term was warranted given the scope of the losses, the number of victims, and his efforts to evade authorities after the collapse.

U.S. District Court Judge Paul Engelmayer finally dropped a vonis against Terraform Labs founder Do Kwon.

At a verdict reading held in Manhattan Thursday (11/12), Kwon was sentenced to 15 years in prison for his role in the US$40 billion crypto fraud scandal that destroyed the… pic.twitter.com/CMHgUoV9S1

— Alpha Intel (@AlphaIntelMedia) December 12, 2025

The defense team of Do Kwon had asked for a five‑year sentence, pointing to his guilty plea and expressions of remorse, but the court found that mitigating factors were outweighed by the breadth of the deception and its systemic ripple effects. As part of the resolution, Do Kwon is required to forfeit millions of dollars in proceeds and give up his stake in Terraform Labs and related crypto holdings, alongside massive civil penalties previously agreed with the U.S. Securities and Exchange Commission.

After Terra’s 2022 collapse, he left South Korea and spent months moving through several countries while both U.S. and Korean authorities pursued criminal investigations. In March 2023 he was arrested in Montenegro while attempting to board a flight using falsified travel documents, setting off a protracted extradition dispute between the United States and South Korea.

He was ultimately transferred to U.S. custody to face federal charges in New York, while still remaining subject to separate criminal proceedings in South Korea related to capital markets violations. Under the terms discussed in court, he may seek transfer to South Korea to serve part of his sentence after completing a substantial portion of his U.S. term, but any move would depend on both countries’ authorities and treaty procedures.

The Terra crash and Kwon’s conviction accelerated a regulatory and enforcement shift in the United States and other major jurisdictions, with authorities treating misleading crypto marketing and opaque token mechanics more like traditional financial fraud. Prosecutors and regulators have explicitly linked the Terra collapse to a chain reaction of failures in 2022, putting Kwon alongside other high-profile crypto executives who have since received lengthy prison sentences for fraud.

For investors and projects, the case serves as a landmark warning that “experimental” token designs and aggressive yield promises will face strict scrutiny, especially when marketed as stable or low‑risk. Legal experts expect the verdict to influence how future stablecoins are structured, disclosed, and supervised, pushing the industry toward more transparent reserves, audited backing, and clearer consumer protections.