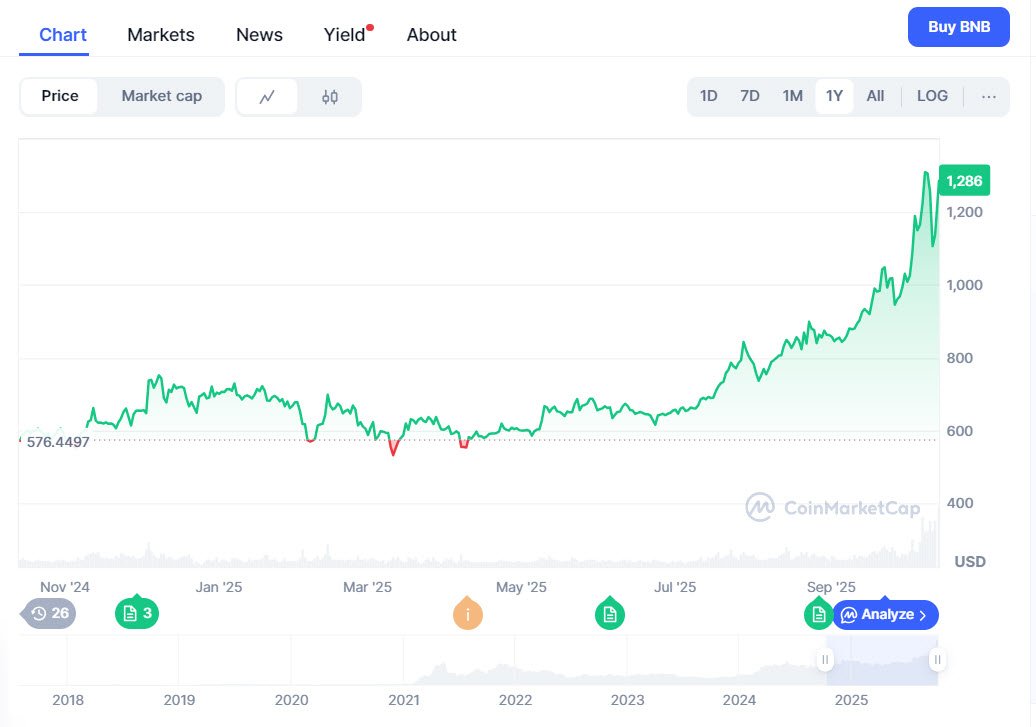

The cryptocurrency market recently witnessed a remarkable event involving Binance Coin (BNB), one of the leading digital assets by market capitalization. In the wake of the biggest flash crash event in recent history on October 10, 2025, BNB’s price surged rapidly to hit a new all-time high just two days later, showcasing the coin’s remarkable resilience and strong investor confidence.

At the time of writing, BNB is trading at $1,289.03, close to its latest all-time high (ATH) of $1,370.55, signaling robust bullish momentum after a turbulent market period.

The flash crash on October 10 was triggered by a combination of geopolitical tensions and fresh US tariff measures on China coupled with restrictions on software exports. This led to massive liquidation across the crypto market, with a staggering $19 billion in positions liquidated within 24 hours, affecting over 1.6 million traders globally.

The event marked the largest liquidation episode in the history of cryptocurrencies, shaking investor confidence and causing major price drops among almost all tokens, including Bitcoin and Ethereum. Bitcoin’s price plunged from record highs near $125,000 to below $105,000 momentarily, while Ethereum and other altcoins witnessed declines between 20% to 50% or more.

Despite this massive market turmoil, BNB stood out with its superior stability and quick recovery. It initially dropped from approximately $1,240 to a low near $860 during the crash but rebounded sharply by over 52% within just 48 hours, climbing back above the $1,300 mark. The rebound was notable in the context of the broader market’s slower recovery and more severe losses experienced by some key competitors.

The surge in BNB’s price was accompanied by a dramatic increase in daily trading volume, exceeding $9.3 billion, pointing to strong accumulation by whales and renewed investor confidence.

Binance’s robust ecosystem plays a pivotal role in BNB’s resilience. As one of the world’s largest cryptocurrency exchanges, Binance commands nearly 40-50% of global spot trading volume and leads derivatives markets with over $2.5 trillion in monthly futures trading. This dominant market footprint ensures deep liquidity for BNB and keeps it integral to market risk rotations.

The coin’s deflationary model, through quarterly token “burn” events, further supports its long-term value by steadily reducing its circulating supply, thereby creating favorable supply-demand dynamics.

Technical analysis highlights a textbook V-shaped recovery for BNB after the flash crash, with price levels returning to pre-crash zones and key moving averages retested as strong support. The 200-day moving averages are now acting as dynamic supports, a classic indicator of a bullish trend consolidation.

Volume profiles show strong confluence near prior ATH zones, providing high-probability confirmation of further upward momentum. Market participants are closely watching BNB as it approaches its previous ATH resistance of $1,370, which represents the final hurdle before potentially breaking into a new price discovery phase.

Investor sentiment around BNB reflects a growing optimism supported by both retail traders and institutional investors. Despite the flash crash-induced fear and uncertainty reflected in crypto market metrics like the Fear & Greed Index, which recently hovered around a neutral 40 mark, interest in BNB has surged due to its demonstrated ability to withstand market shocks.

The coin’s quick recovery and continued demand have reinforced Binance’s position as a leading exchange and BNB as one of the most reliable altcoins for both short-term traders and long-term holders.

Analysts project continued strength for BNB as the market enters the final quarter of 2025. The coin’s ongoing integration within Binance’s ecosystem, expanding adoption, and low supply due to burns are all factors expected to support further price gains. While volatility remains a characteristic of cryptocurrency markets, BNB’s strong fundamentals and Binance’s dominant market presence provide a solid foundation for sustained bullish momentum.

This has led many investors to speculate that BNB could surpass its current ATH and reach new heights before year-end.

The historic flash crash of October 10, 2025, while a moment of panic for many, has instead become a catalyst for BNB’s resurgence, highlighting its unique position in the crypto landscape. As the third-largest cryptocurrency by market capitalization, BNB continues to attract both new investors and seasoned traders, making it a critical asset to watch in the months ahead.